What is the First Home Loan Deposit Scheme?

The Australian Government has introduced the First Home Loan Deposit Scheme to support first home buyers to purchase a home sooner. It does this by providing a guarantee that will allow eligible first home buyers to purchase a home with a deposit of as little as 5 per cent without needing to pay for lenders mortgage insurance.

The Scheme will support up to 10,000 guaranteed loans per financial year from 1 January 2020. Eligible borrowers can use the guarantee in the conjunction with other government programs like the First Home Super Saver Scheme or state and territory first home owner grants and stamp duty concessions.

The guarantee is not a cash payment or a deposit for your home loan.

How does the Scheme work?

Eligible first home buyers are able to obtain an eligible loan to purchase an eligible property through a participating lender with up to 15 per cent of the value of the property guaranteed by NHFIC.

What type of property can be bought under the Scheme?

For a property to be a eligible it must be a ‘residential property’ – this term has a particular meaning under the Scheme, and you should ask your lender if there is any doubt. Eligible residential properties include:

- An existing house, townhouse or apartment

- A house and land package

- Land together with a seperate contract to build a home

- An off-the-plan apartment or townhouse

Specific dates and requirements apply for the different property types.

Who is eligible for the Scheme?

- Australian citizens who are at least 18 years of age. Permanent residents are not eligible.

- Singles with a taxable income of up to $125,00 per annum for the previous financial year and couples with a taxable income of up to $200,00 per annum for the previous financial year. For all Scheme applications made from 1 January to 30 June 2020, the relevant financial year will be 2018-19.

- Couples are only eligible for the Scheme if they are married or in a de-facto relationship with each other. Other persons buying together, including siblings, parent/child or friends, are not eligible for the Scheme.

- The Scheme is to assist singles and couples (together) who have at least 5 per cent of the value of an eligible property saved as a deposit. If you have 20 per cent or more saved, then your home loan will not be covered by the Scheme.

- Loans under the Scheme require scheduled repayments of the principal and interest of the loan for the full period of the agreement (with limited exceptions for interest-only loans, which mainly relate to construction lending).

- Applications must intend to be owner occupiers of the purchased property. Investment properties are not supported by the Scheme.

- Applicants must be first home buyers who have not previously owned or had an interest in a property in Australia either separately or jointly with someone else (this includes residential strata and company title properties).

To find out more about the eligibility criteria for borrowers and properties visit www.nhfic.gov.au/what-we-do/fhlds/eligibility

Do property price thresholds apply?

Yes, the objective of the Scheme is to assist in the purchase or construction of a modest home and the value of the residential property must not exceed the relevant price cap for the area in which it is located. The price caps for capital cities, large regional centres and regional areas are:

- NSW

- Capital City and Regional Centres: $700,000

- Rest of State: $450,000

- VIC

- Capital City and Regional Centres: $600,000

- Rest of State: $375,000

- QLD

- Capital City and Regional Centres: $475,000

- Rest of State: $400,000

- WA

- Capital City and Regional Centres: $400,000

- Rest of State: $300,000

- SA

- Capital City and Regional Centres: $400,000

- Rest of State: $250,000

- TAS

- Capital City and Regional Centres: $400,000

- Rest of State: $300,000

- ACT

- Capital City and Regional Centres: $500,000

- NT

- Capital City and Regional Centres: $375,000

- Jervis Bay Territory and Norfolk Island

- $450,000

- Christmas Island and Cocos (Keeling) Islands

- $300,000

The capital city price thresholds apply to regional centres with a population over 250,000 (Newcastle & Lake Macquarie, Illawarra (Wollongong), Geelong, Gold Coast and Sunshine Coast), recoginising that dwellings in regional centres can be significantly more expensive than other regional areas.

Look up your suburb or postcode on NHFIC’s website to get an indication of the relevant property price threshold – www.nhfic.gov.au/what-we-do/fhlds/property-price-thresholds/

More Info?

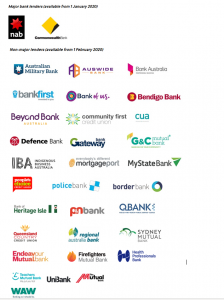

- You must apply for the Scheme through a participating lender or your broker. You can see the full list of participating lenders on the NHFIC’s website at www.nhfic.gov.au/what-we-do/fhlds/how-to-apply

- There are no costs or repayments associated with the Scheme guarantee. However, you are responsible for meeting all costs and repayments for the home loan associated with the guarantee.

- The Scheme commences on 1 January 2020 for the participating major bank lenders and on 1 Febuary 2020 for the non-major lenders.

- NHFIC will not accept applications directly and does not maintain a waiting list for places under the Scheme.

To find out more about the application process, visit NHFIC’s website at www.nhfic.gov.au

How do I apply?

Contact us to discuss further or to see if your eligible on 1300 70 70 39 or send us an enquiry at https://www.rostronmortgages.com.au/apply-now/